Taxes by revenue centers

Maitre'D taxes by Revenue Center report shows taxes information by Revenue Center for the date or the period of time requested. From the report filter window, select the appropriate dates, Revenue Centers and modes to be included in the report.

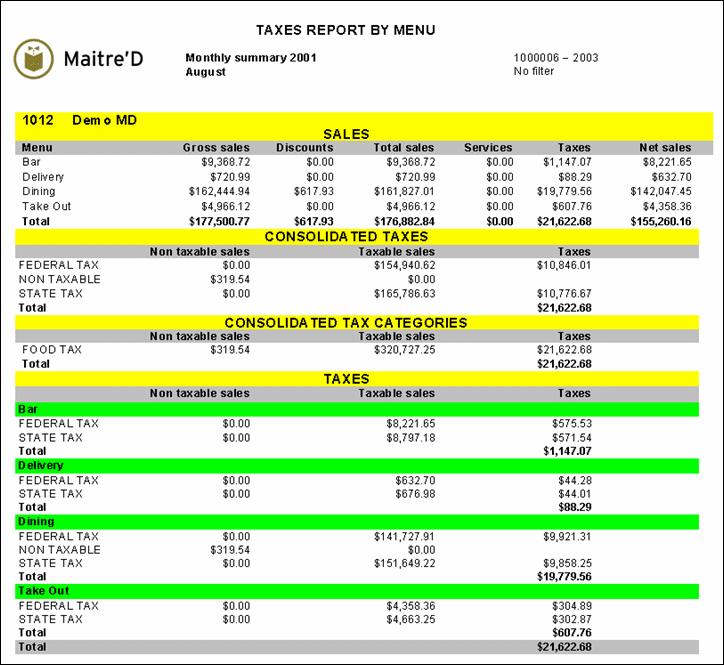

The following is a sample of the taxes by Revenue Center report:

The report is divided in four sections. For each Revenue Center, the Sales section provides you with:

Revenue Center

Revenue Center description.

Gross sales

Sales including discounts, service charges and net sales.

Discounts

Discounts applied in this Revenue Center.

Total sales

Gross sales minus discounts.

Services

Service charges applied for this Revenue Center.

Taxes

Total of taxes applied on taxable sales for this Revenue Center.

Net sales

Total sales minus service charges and taxes.

For all taxes, the Consolidated Taxes section provides you with:

Non taxable sales

Sales on which no taxes apply.

Taxable sales

Sales on which any tax is applied.

Taxes

Taxes applied on taxable sales.

For all tax categories, the Consolidated Tax Categories section provides you with:

Non taxable sales

Sales on which no taxes apply.

Taxable sales

Sales on which any tax is applied.

Taxes

Taxes applied on taxable sales.

For all Revenue Centers, the Taxes section provides you with:

Non taxable sales

Sales on which no taxes apply for this Revenue Center.

Taxable sales

Sales on which any tax is applied for this Revenue Center.

Taxes

Total of taxes applied on taxable sales for this Revenue Center.

Last updated

Was this helpful?